15 years, 11 states, $42 million in loans and leases processed, over 16,000 families supported!

Funds from the LENDonate loan supported Capital Good Fund’s Crisis Relief Loan (“CRL”) – a loan product that was launched in March of 2020 and resulted in 3,406 loans totaling over $3 million. This has been transitioned to a similar product called the Impact Loan and they’ve now originated 3,067 loans for $3.023 million—and the product is still available.

“One of our goals is to put poverty out of business.”

– Andy Posner, CEO & Founder – Capital Good Fund

The LENDonate loan has successfully been paid off using earned income and revolving loans receivable.

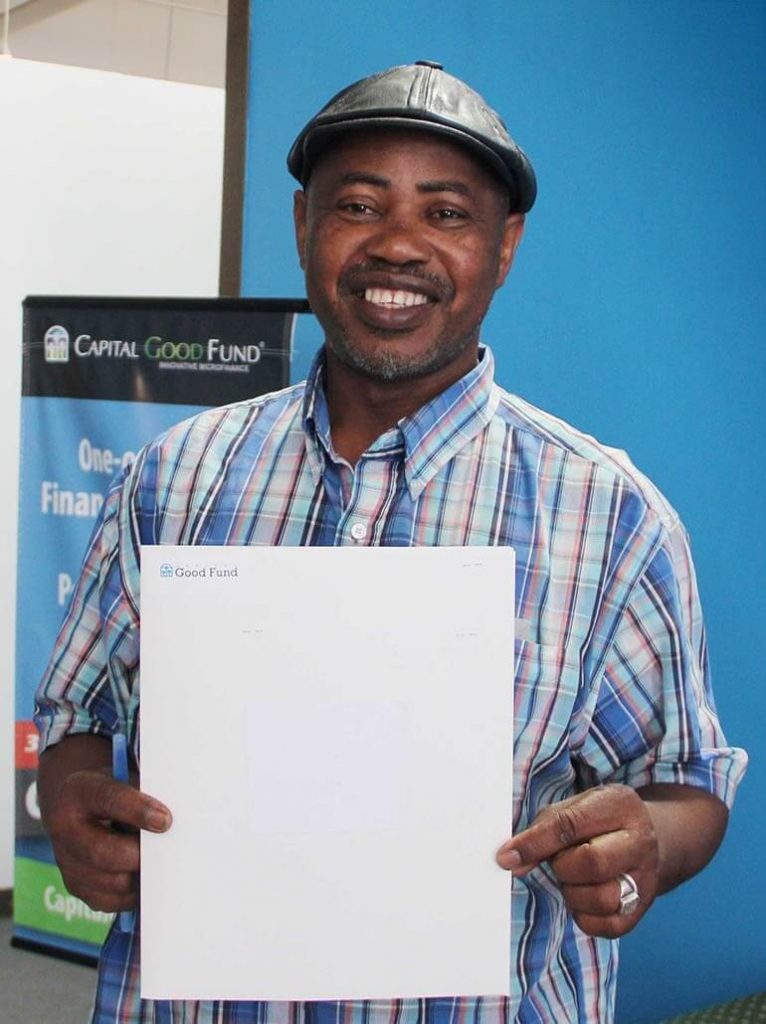

Low-income Americans face numerous obstacles to building better lives for themselves and their families. For many, the promise of the American Dream seems to be slipping away. Access to capital is one barrier that has many ramifications that are essential for economic uplift, including access to jobs, healthcare, quality schools and a safe place to live. That’s where Capital Good Fund comes in. Since 2009, Capital Good Fund has financed nearly 6,000 small-dollar personal loans totaling $12 million and graduated nearly 1,700 families through their Financial & Health Coaching program. Despite lending to a population that is deemed non-credit worthy or excluded from the credit system, our current portfolio at risk (30+ days past due) is less than 4% and our all-time net charge off rate is just 5%. The majority of borrowers are female and almost three-quarters identify as a minority. Capital Good Fund’s services help low-income individuals avoid triple-digit predatory lending services that lead to debt spirals, bankruptcy, and homelessness.

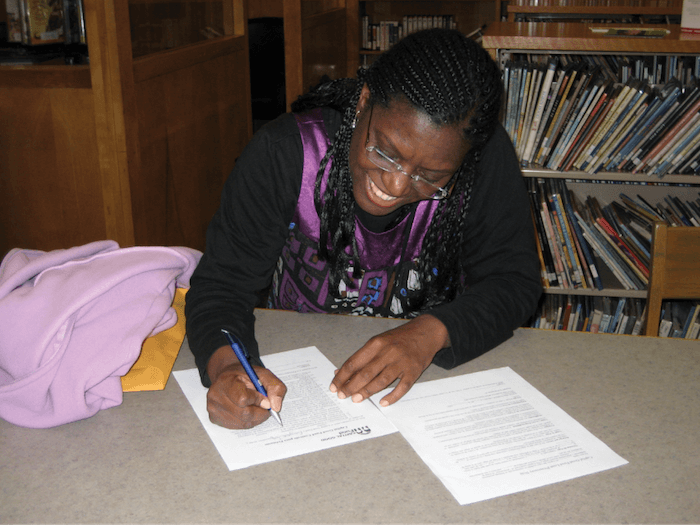

Sherlie’s old car was breaking down and becoming dangerous for Sherlie and her daughter. Good Fund gave her a Car Loan so she could afford safe, reliable transportation for her family. Sherlie and her daughter can now get to work, school, or anywhere life takes them! Click here to watch her story.

Capital Good Fund lends to individuals and households that do not have access to traditional credit due to issues related to income, mobility, language, immigration status, mistrust of the financial system, and historical and ongoing racism. Despite lending to a population that is deemed non-credit worthy or excluded from the credit system, they have an 11-year track record of successful loan making.

Loan proceeds are used for a variety of purposes:

Crisis Relief Loans (“CRL”) was launched in March and over 550 CRLs have been issued. Funds from the LENDonate loan will support the Crisis Relief Loans, the area of biggest need at present, as well as, the entire suite of equitable loan products.

One of our goals is to put poverty out of business

- Andy Posner, CEO & Founder - Capital Good Fund

Click here to read more on CNBC

MISSION: To create pathways out of poverty and advance a green economy through inclusive financial services.

VISION: Capital Good Fund is a social justice organization that uses financial services as a tool to promote the values of:

ORGANIZATION: With headquarters in Rhode Island, Capital Good Fund is a nonprofit, certified Community Development Financial Institution that helps people fix their finances by offering small loans and personalized Financial + Health Coaching to families in Rhode Island, Florida, Massachusetts, Illinois and Delaware.

A password will be e-mailed to you.