Northern California Land Trust

Investment Summary

- Total Raise: $540,600

- Investment Risk Rating: Gold

- Investment Ceiling Rate: 4.0%

- Investment Term: 5 Years

- Investment Closes: April 1, 2022

Who can participate?

- Everyone can donate.

- Only Accredited Investors can lend/invest. Minimum $100.

Who They Are: Northern California Land Trust (NCLT)

Founded by community activists in 1973, the Northern California Land Trust (NCLT) is a community-based non-profit committed to making homes and community facilities permanently affordable through the Community Land Trust (CLT) model. NCLT envisions a future where safe, high-quality homes in healthy, sustainable communities are permanently affordable to — and controlled by — residents, regardless of socio-economic status, geographic location, race, religion, gender, orientation or physical ability.

Unlike most other affordable housing developers, NCLT retains the rights to the land below the house to ensure that the home is resold at affordable, below-market rates to each subsequent homebuyer, guaranteeing low-cost housing in perpetuity. Through the land lease, the appreciation of the home value is limited, keeping it permanently affordable.

NCLT executes their mission by providing housing services, community development, and consulting/training services. They revitalize or develop properties and then sell the homes at below-market cost to residents who have been trained by NCLT for home ownership responsibilities. To meet the needs of specific housing project types, NCLT designs and implements training programs. They have a training program for their limited-equity cooperative owners, limited-appreciation condominium owners, as well as single-family CLT homeowners. They work in partnership with other financial literacy and education programs to help purchasers be ready to buy when a unit is available. The objective of these programs is to give residents the information and foster the skills they need in areas like planning reserve budgets, bookkeeping, home maintenance, earthquake safety, meeting skills and conflict resolution.

Use of Proceeds: Refinance of Short-Term Loan

Why Support this Program?

Jocelyn’s story was featured in this KQED news article.

In February 2020, Jocelyn Foreman faced the nightmare of an eviction upon the foreclosure on the Pinole house she was renting. Unbeknownst to her, the landlord was having trouble making the mortgage payments.

This house is remarkable for Jocelyn who has called it home (as a tenant). Jocelyn & her family have suffered from homelessness. Establishing tenancy in this home gave her the stability to create and implement an innovative program in the local school district –to intervene & support other families suffering through homeless & economic crisis–with a district wide food, clothing & tutoring program.

The community she has touched stepped up with nearly 1,000 people donating more than $175K to support the purchase and rehab of the home. Jocelyn is currently enrolled in NCLT’s credit & income counseling program; it is anticipated that she will be able to afford a mortgage of $275K, and be ready within 3 to 5 years.

“This house was so important to me. It was my opportunity to break the cycle, for myself and for my children.”

~Jocelyn Foreman

The WIN Project

Investment Summary

This investment note is for a construction loan used to finance the development of 5 low-income SFRs in the City of Compton, California.

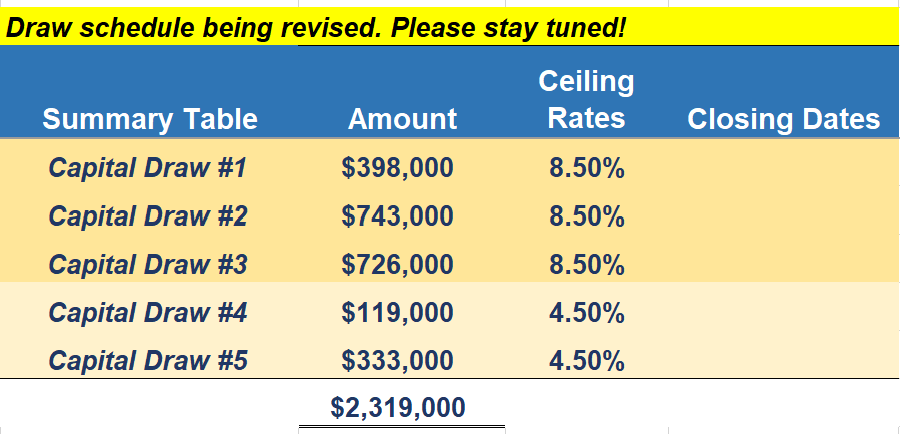

There will be 5 capital draws during construction. The table summarizes the individual draw dates. Investment note details are outlined below.

CAPITAL DRAW 1, 2, and 3

- Total Raise: $1,867,000

- Investment Risk Rating: Bronze

- Investment Ceiling Rate: 8.5%

- Investment Term: 2 Years

- Investment Security: UCC-1 lien

- Investment Closes: March 24, 2022, April 14, 2022 and June 30, 2022

CAPITAL DRAW 4 and 5

- Total Raise: $452,000

- Investment Risk Rating: Gold

- Investment Ceiling Rate: 4.5%

- Investment Term: 2 Years

- Investment Security: UCC-1 lien

- Investment Closes: September 13, 2022 and October 6, 2022

Who can Participate?

- Everyone can donate.

- Only Accredited Investors can lend/invest.

Who They Are: The WIN Project

The WIN Project exists to create strong communities with quality affordable homes that improve the quality of life for residents in the community. The housing is inclusive and sustainable contributing positively to communities free from discrimination.

Through Government Programs, Grants, and Donations from individuals, The Win Project purchases the property and develops permanent housing using local contracted trade associates who are licensed, tenured, and insured with years of experience. They are doing their part to fuel the economy and give families a sense of home ownership and pride. They take great care in designing comfortable living solutions for lower income buyers either by building from ground up and by remodeling what has fallen.

Use of Proceeds & Source of Repayment

The loan proceeds will help fund the construction of 5 SFRs. The total project cost is $2,554,805 which includes Borrower’s Equity, City of Compton land loan and interest reserve.

Monthly payments to be paid from the interest reserved account. Principal repayments to be paid from sales proceeds as each home is sold, expected to start in Q4 2022.

Why Support this Program?

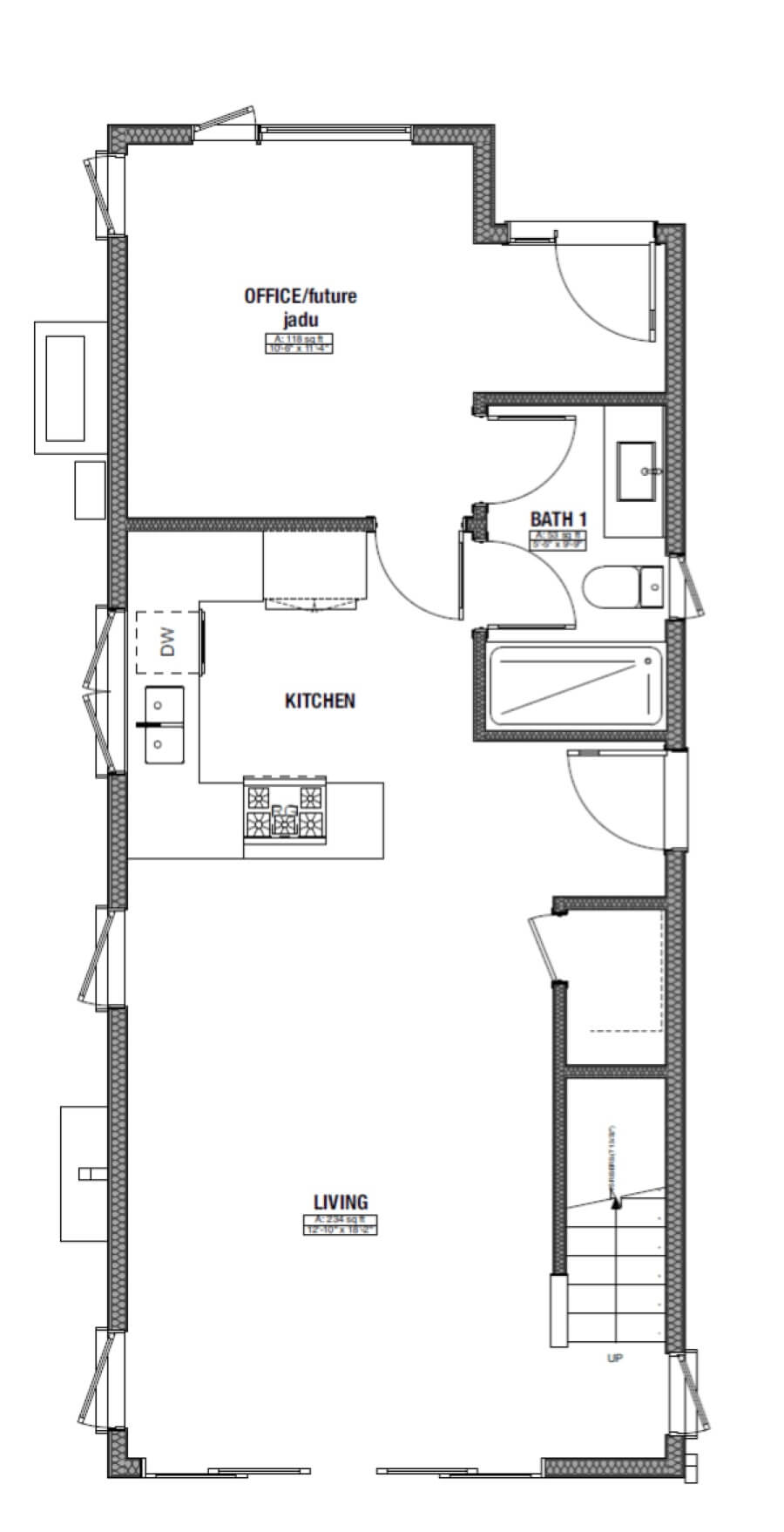

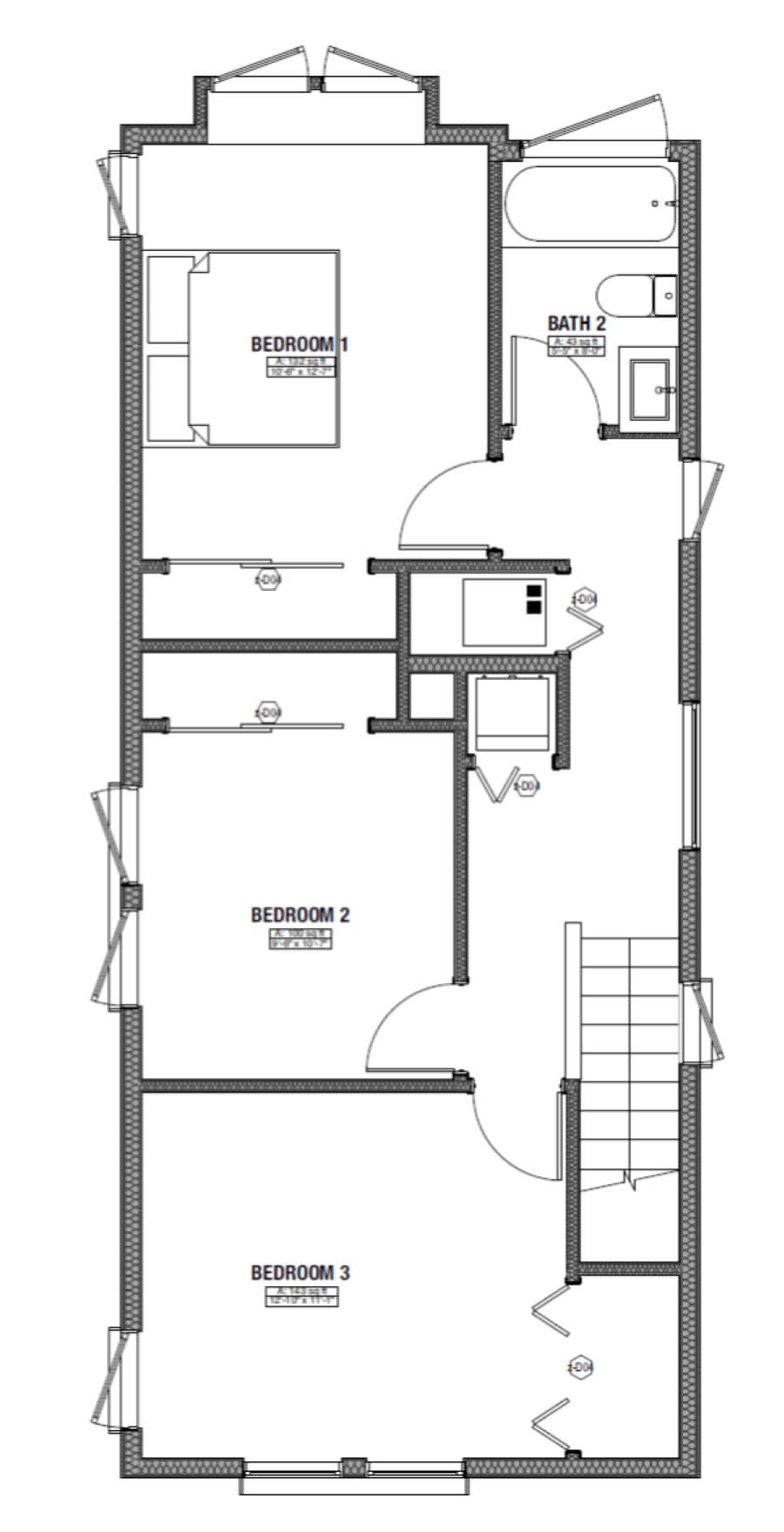

The WIN Project has won the City of Compton bid to develop 5 affordable resale single family housing. Each property is zoned mixed use with the 5 SFRs being developed as live-work homes in which the owner may choose to operate a business from the home. This enables the new owner an opportunity to develop new revenue streams. This project brings together the need for affordable housing and the requirement of self-driven economic development in the form of entrepreneurship. The target population is the low-income individual that is subsidizing their income with service delivery.

All 5 SFRs are 100% affordable housing development and will be built to affordability standards using the HUD HOMES guidelines for resale pricing and household income limits. The WIN Project will work closely with Los Angeles County to assist low-income home buyers to access special homeownership programs including First Home Mortgage Program and Home Ownership Program.

Additional Information about the Borrower

The WIN Project has over 25 years of experience as a non-profit developer specializing in high impact affordable and general housing development projects in urban neighborhoods. They have a long and accomplished relationship with the City of Compton. The WIN Project owns and manages four low-income housing projects in Compton. They are also an approved partner in good standing of the Los Angeles Homeless Services Authority which serves as the vetting provider for the Los Angeles Continuum of Care. Their expertise includes land use and planning, real estate appraisal development and sales, consultation for housing, land acquisition and urban blight projects, eminent domain relocation and acquisition and general project management. The WIN Project has a deep history involving many development projects working as a partner to private developers and other developer agencies and municipalities.

PROJECT TEAM

Regina Young, Executive Director of The WIN Project

Quality Building Contractors Co., General Contractor and Project Manager

office42 Architecture

Paul Reyes-Fournier, Vision Driven Consulting

Roy McGarrell & Co, CPA

Target Evolution

Investment Summary

- Total Raised: $50,000

- Investment Risk Rating: Bronze

- Investment Ceiling Rate: 9.0%

- Investment Term: 12 Months

- Investment Closes: February 15, 2022

Who can participate?

- Everyone can donate.

- Only Accredited Investors can lend/invest. Minimum $100.

Who They Are: Target Evolution Incorporated

Seeing a need for energetic, nonprofit work in the area of teen unemployment and 21st Century skills, Target Evolution was formed in 2011 to provide sensible solutions.

Target Evolution’s methodology puts experiential learning at the center of a data-driven and evidence-based approach to youth entrepreneurship education and development. It includes Lean Startup, Remote-Work Experience, and a Pop-Up Shop providing youth and young adults the opportunity to earn money with their own small business upon successful completion.

Use of Proceeds: Working Capital

The loan proceeds will be used for working capital and marketing/promotion. With national attention and more youths attracted to their programs, Target Evolution will be able to conduct in-depth research and produce data to present to government entities on the impact of youth entrepreneurship education in low-income communities.

Their source of repayment will be from government contracts with Workforce Solutions in 3 Texas regions, tuition from their Teen Biz Camp program, and pending grants and sponsorships.

Why Support this Program?

“I’ve learned so much about business with this program, but also been given the tools to teach other youth about business and entrepreneurship.”

Brice E.

CEO of Vallaire's for Men, Age 13

Nerfertiti M.

CEO of Sugadoo Cosmetics, Age 13

Sanyia S.

CEO of Simone's Stones, Age 14