Select a button to learn more about a topic.

All of these statements are true! 1) Nonprofits can be profitable. 2) Nonprofit is a tax status, not a business operating model. 3) Nonprofits must use all their profit on expenses that support their mission.

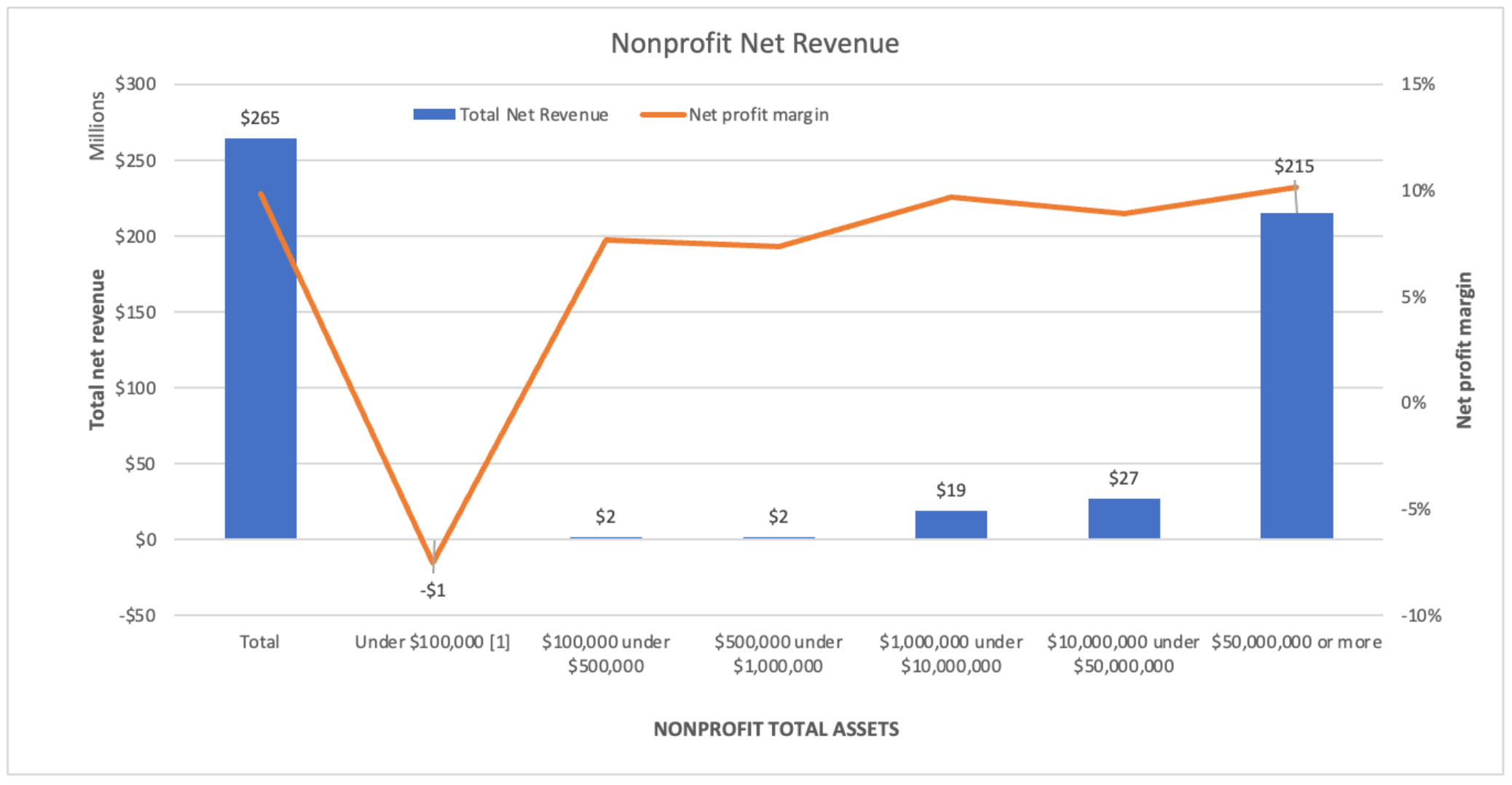

Is it a problem that some nonprofits are profitable? No. Contrary to common (mis)perception, the IRS code does not require organizations classified as 501(c)(3) to have no profit. Rather, the code specifies that these organizations use any profit to fulfill their mission. Unlike for-profit companies, nonprofits do not pass along their profit to “owners.” They put it right back to work for the communities they serve.

LENDonate is the first lending marketplace dedicated to providing nonprofits with access to reasonably priced loans, so they can continue to do what they do best: create change. Discover how your investments can help amplify the direct impact that nonprofits make in our communities.

(1)IRS Statistics of Income, data for Tax Year 2020. “Table 1: Form 990 of Returns of 501(c)(3) Organizations, Balance Sheet and Income Statement Items, By Asset Size” (accessed Sep 19, 2024).

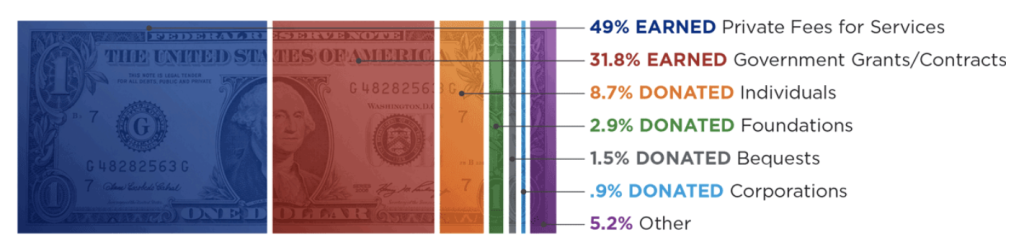

It may surprise you that 81% of nonprofit revenue comes from fees and services.

LENDonate is the first lending marketplace dedicated to providing nonprofits with access to reasonably priced loans, so they can continue to do what they do best: create change. Discover how your investments can help amplify the direct impact that nonprofits make in our communities.

National Council of Nonprofits. “Nonprofit Impact Matters."

On average, 5.1-5.6% of US GDP comes from nonprofits.

While few of us take the social or environmental impact of #nonprofits for granted, we tend to overlook how important they are for our economy. Did you know that through fundraising, grants, earned income and other activities, nonprofits boast revenue that rivals major for-profit US sectors? In fact, the revenue of the nonprofit sector was $2.7 trillion.(1) This sector is estimated to have contributed 5.6% to the US GDP.(2)

Why does this matter? Like for-profit entities, nonprofits use their revenue to provide services. But how do nonprofits operate when grants and accounts receivables are delayed? How do they grow when demand spikes? Faced with a similar situation, a for-profit entity in another US sector might turn to the capital markets for loan, bond, or equity financing. Nonprofits, on the other hand, lack this access. One reason? We underestimate how robust and strong the nonprofit sector truly is.

LENDonate is the first lending marketplace dedicated to providing nonprofits with access to reasonably priced loans, so they can continue to do what they do best: create change. Discover how your investments can help amplify the direct impact that nonprofits make in our communities.

(1)IRS Statistics of Income, data for Tax Year 2020. “Table 1: Form 990 of Returns of 501(c)(3) Organizations, Balance Sheet and Income Statement Items, By Asset Size” (accessed Sep 19, 2024).

(2)U.S. Bureau of Economic Analysis, “Table 1.3.5. Gross Value Added by Sector” (accessed Thursday, September 19, 2024).

Diversify your investments while doing good. Learn how to get started as a LENDonate investor.

LEARN MOREWhether you're a nonprofit exploring options or a potential lender, registration is the first step.

START INVESTINGView investment opportunities available on our marketplace and learn more about recently funded projects.

READ INSIGHTSA password will be e-mailed to you.